Cheap Car Insurance in Oklahoma (2025)

Best cheap car insurance in Oklahoma

Cheapest full-coverage car insurance in Oklahoma: State Farm

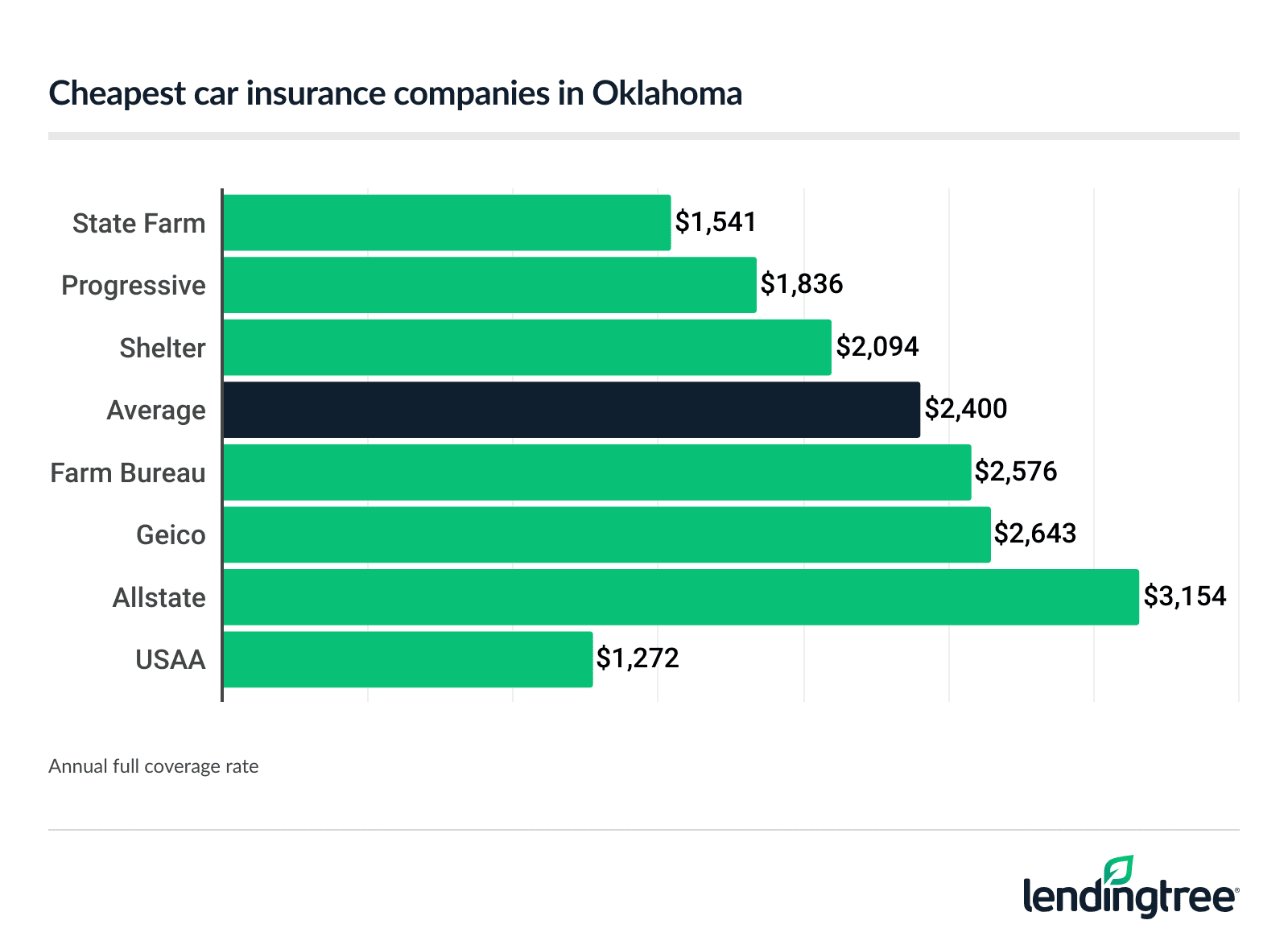

USAA has the cheapest full-coverage auto insurance overall at $106 a month. However, USAA is only available to military community members and their families.

Full-coverage auto insurance rates

| Lender name | LT rating | Minimum FHA credit score |

|---|---|---|

| Flagstar Bank | 8 | Not published |

| PennyMac Loan Services | 9 | 620 |

| Guild Mortgage | 9 | 540 |

| CashCall | 8.5 | 560 |

| AmeriSave Mortgage Corporation | 8 | 600 |

Full coverage includes collision Collision covers your car for damage from a collision with another vehicle or object. and comprehensive Comprehensive covers your car for theft or damage from non-collision causes like fire, flood and vandalism. , which cover damage to your own car. Neither coverage is required by law, but you usually need it for a car loan or lease.

The average cost of full coverage is $200 a month statewide. Your actual rate depends on factors like your driving history, location and credit. Each company weighs these factors differently. This makes it good to compare car insurance quotes from a few different companies.

Cheapest Oklahoma liability car insurance: State Farm

Although Progressive is slightly more expensive than State Farm for liability auto insurance Liability covers injuries and damage you cause to others. It’s required by law. , it also offers a few more coverage options. For example, Progressive offers gap insurance and accident forgiveness, which State Farm does not have.

Liability-only auto insurance rates

| Program name | Assistance amount | Assistance type | Where it’s available |

|---|---|---|---|

| Colorado Housing and Finance Authority (CHFA) Down Payment Assistance Grant | Up to 3% of first mortgage for down payment and/or closing costs | Grant | All counties and cities in Colorado |

| CHFA Down Payment Assistance Second Mortgage Loan | Up to 4% of first mortgage for down payment and/or closing costs | Second mortgage loan | All counties and cities in Colorado |

| NEWSED CDC Down Payment Assistance | Variable amount for down payment and closing costs, up to $6,500 depending on need | Silent second loan | Denver metropolitan area (Adams, Arapahoe, Broomfield, Denver, Douglas and Jefferson counties) |

| MetroDPA Down Payment Assistance | Up to 6% of a 30-year loan for down payment and closing costs | Forgivable second mortgage | Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas, Elbert, Jefferson and Larimer counties |

| Boulder County Down Payment Assistance | Up to 10% of purchase price for down payment and closing costs (not to exceed $40,000) | 10-year loan or deferred loan, depending on income | Boulder County outside of Boulder city limits |

Best cheap car insurance for Oklahoma teens: State Farm

- State Farm’s liability rates for teens average $126 a month. Shelter is the next-cheapest company for teen liability insurance at $143 a month.

- State Farm’s full-coverage rates for young drivers average $342 a month. This is 21% less than the second-cheapest rate of $342 a month from Shelter.

Teens’ lack of driving experience makes them more likely to crash than older drivers. This is one of the main reasons why teens have such high insurance rates.

Annual car insurance rates for teens

| Program name | Credit score minimum | DTI ratio maximum | Maximum income limit | How long you have to live in home |

|---|---|---|---|---|

| CHFA Down Payment Assistance | 620 | Contact program | Varies by county and program type | Contact program |

| NEWSED CDC Down Payment Assistance | No minimum | 45% | Total for all residents must not exceed 80% of median income for Denver | No minimum |

| MetroDPA Down Payment Assistance | 640 | Unknown | $150,000 | Unknown |

| Boulder County Down Payment Assistance | Unknown | Unknown | 60%-80% of median income for Boulder County | Unknown |

Young drivers usually get cheaper rates when added to a parent’s car insurance than they do on their own. State Farm, Shelter and many other companies also give teens car insurance discounts for:

- Getting good grades

- Completing a driver’s training program

State Farm also gives teens a discount for going off to college without a car. Shelter doesn’t offer this discount.

Best Oklahoma car insurance rates after a ticket: State Farm

A speeding ticket raises the average price of insurance in Oklahoma by 20% to $240 a month. If you have a bad driving record, it’s especially important to shop for cheap auto insurance quotes.

Car insurance rates after a ticket

| Program name | Assistance amount | Assistance type | Where it’s available |

|---|---|---|---|

| First Place | 6% of home price for down payment assistance | Forgivable second mortgage | Statewide |

| Next Home | 3.5% of home price for down payment assistance | Forgivable second mortgage | Statewide |

| Mortgage Credit Certificate | 25% of mortgage up to $2,000 | Tax credit | Statewide |

| Fort Wayne Downpayment Assistance Program | Up to $8,000 for down payment and closing costs | Forgivable second mortgage | Fort Wayne |

| HAND Down Payment and Closing Cost Assistance | Up to $10,000 for down payment and closing costs | Forgivable second mortgage | Bloomington |

Cheap Oklahoma car insurance after an accident: State Farm

Car insurance rates after an accident

| Program name | Credit score minimum | DTI ratio maximum | Maximum income limit | How long you have to live in the home |

|---|---|---|---|---|

| First Place | 640 or 680 | 45% to 50%, depending on credit score | Varies by county and household size from $73,300 to $406,066 | 9 years |

| Next Home | 640 or 680 | 45% to 50%, depending on credit score | Varies by county and household size from $73,300 to $406,066 | 9 years |

| Mortgage Credit Certificate | 640 or 680 *used in conjunction with Next Home | 45% to 50%, depending on credit score *used in conjunction with Next Home | Varies by county and household size from $73,300 to $406,066 | 9 years |

| Fort Wayne Downpayment Assistance Program | Set by lenders | Set by lenders | Varies by household size from $40,250 to $75,900 | 5 years |

| HAND Down Payment and Closing Cost Assistance | None | 41% to 55% | Varies by household size from $42,750 to $80,600 | 5 years |

Cheap Oklahoma car insurance for bad teen drivers: State Farm

- State Farm’s liability rates for teens with a speeding ticket average $137 a month. Shelter is the next-cheapest company at $174 a month.

- State Farm also has the cheapest car insurance for teens with an accident at $126 a month. Shelter charges teens with a prior accident an average of $206 a month.

Annual insurance rates for teens with a ticket or accident

| Score | Explanation |

|---|---|

| 100 | Payment 30 days sooner than terms |

| 90 | Payment 20 days sooner than terms |

| 80 | Payment on terms |

| 70 | Payment 15 days beyond terms |

| 60 | Payment 22 days beyond terms |

| 50 | Payment 30 days beyond terms |

| 40 | Payment 60 days beyond terms |

| 30 | Payment 90 days beyond terms |

| 20 | Payment 120 days beyond terms |

| 1-19 | Payment over 120 days beyond terms |

Cheapest Oklahoma DUI insurance: Progressive

A DUI raises the average cost of car insurance by 50% to $300 a month statewide.

Car insurance rates after a DUI

| Program name | Assistance amount | Assistance type | Where it’s available |

|---|---|---|---|

| Anne Arundel County Mortgage Assistance Program | Up to $20,000 | 0% interest loan | Anne Arundel County |

| Settlement Expense Loan Program (SELP) | $10,000 | Forgivable loan | Baltimore County |

| Montgomery County Homeownership Assistance Fund | 40% of the total qualifying household income, up to $25,000 | Forgivable loan | Montgomery County |

| City of Frederick’s Community Partners Incentive Program (CPIP) | Up to $5,000 | 0% interest loan | City of Frederick |

Best Oklahoma car insurance rates for bad credit: Farm Bureau

Insurance companies check your credit for things like your payment history and borrowing amounts. Avoiding late payments and paying down debts is a good way to lower your car insurance rates.

Bad credit car insurance rates

| Program name | Credit score minimum | Debt-to-income (DTI) ratio maximum | Maximum income limit | How long you have to live in home |

|---|---|---|---|---|

| Anne Arundel County Mortgage Assistance Program | No credit score requirements | 45% back-end ratio | May not exceed 80% of area median income | No specified time, but loan is due and payable upon sale or transfer, when the property ceases to become a primary residence, or in 30 years, whichever comes first |

| Settlement Expense Loan Program (SELP) | Unknown | Housing and total debt ratios cannot exceed 31% and 43%, respectively | May not exceed 80% of the area median income | 7 years |

| Montgomery County Homeownership Assistance Fund | 640 | 50% | $105,840-$176,400, depending on size of household | 10 years |

| City of Frederick’s Community Partners Initiative Program (CPIP) | 640 | 50% | $154,800-$180,600, depending on size of household | No time frame, but loan is repayable at time of payoff, refinance, sale or transfer |

Oklahoma’s best car insurance companies

Along with low rates, State Farm has a good customer satisfaction score from J.D. Power. These ratings are based on customer surveys grading insurance companies for things like price, coverage options and customer service.

Shelter and Farm Bureau have better customer satisfaction ratings than State Farm. This is a good reason to also get quotes from these companies when you buy or renew your car insurance.

USAA has the highest overall customer satisfaction rating among all Oklahoma car insurance companies. This and its low rates help make it a top choice for military families.

Oklahoma car insurance company ratings

| Program name | Assistance amount | Assistance type | Where it’s available |

|---|---|---|---|

| KHC down payment assistance | Up to $6,000 | Repayable 10-year loan | Statewide through KHC-approved lenders |

| KHC Home Buyer Tax Credit | Equal to 25% of the annual mortgage interest paid in calendar year | Federal tax credit | Statewide through KHC-approved lenders |

| Louisville Metro Down Payment Assistance Program | Maximum of 20% of the home’s purchase price | Partially forgivable loan with 0% interest; 50% forgiven after specified time period, remainder due upon sale of the home | Louisville Metro area |

| Lexington-Fayette Urban County Government (LFUCG) First-Time Homebuyer Program | Varies | Non-repayable mortgage subsidies and 0% to 2% loans | Lexington |

*USAA only sells insurance to members of the military and their families.

**Source: J.D. Power 2024 U.S. Auto Insurance Study. Higher is better; 644 is average.

Oklahoma car insurance rates by city

Forest Park has the state’s most expensive car insurance at $227 a month. This is 13% higher than the state average. The Village has the next-highest rate at $226 a month.

Rates in Oklahoma City and Tulsa work out to $219 a month in each city. This is about 10% higher than the state average.

Car insurance rates near you

| Lower | Better Mortgage | Fairway Independent Mortgage | |

|---|---|---|---|

| Minimum credit score |

|

|

|

| Minimum down payment |

|

|

|

| Loan products and types |

|

|

|

| Special programs offered |

|

|

|

| Lender Review | Better Mortgage | Fairway Independent Mortgage |

Minimum coverage for car insurance in Oklahoma

| Program name | Credit score minimum | DTI ratio maximum | Maximum income limit | How long you have to live in the home |

|---|---|---|---|---|

| KHC down payment assistance | 620 | 45% | $113,925 to $149,450* | Duration of loan |

| KHC Home Buyer Tax Credit | 620 | N/A | $78,120 to $119,560** | Duration of loan |

| Louisville Metro Down Payment Assistance Program | N/A | 43%, or 50% if including student loans | $43,050-$71,350 (at or below 80% of the area median income)*** | Duration of loan (between 5 and 15 years, depending on amount of assistance) |

| Lexington-Fayette Urban County Government (LFUCG) First-Time Homebuyer Program | Dependent upon agency program | Dependent upon agency program | Dependent upon agency program | Dependent upon agency program |